Learn » Blog » Understanding tax in KiwiSaver - everything you need to know

Understanding tax in KiwiSaver - everything you need to know

Published on 15/05/2023

Topics:

kiwisaver

If you joined KiwiSaver before 31 March 2023, you’d have already received, or will be about to receive your annual member statement and tax certificate for the financial year that ended on 31 March 2023. The member statement is a summary of the investment transactions, fees and performance in your KiwiSaver account for the financial year, and the tax certificate shows how much tax has automatically been deducted from your investments - both of these provide information for your records and you generally don’t need to do anything, but it is a good idea to check the tax certificate to confirm that the correct tax rate is being applied - read on for a brief explanation of how to do that.

Firstly, you should be aware that if your employer is making contributions to your KiwiSaver, they need to deduct tax from those contributions before they are paid to your account. This is called Employer Superannuation Contribution Tax (ESCT), and the rate your employer applies depends on how much you earn and how long you have worked for them. As ESCT is deducted by your employer before their contribution reaches your KiwiSaver account, you won’t see this on your tax certificate - take a look at your payslips or ask your employer if you want to know more about ESCT.

Once funds are in your KiwiSaver account, You pay tax on the income your investment generates. We track the tax position of your investment throughout the year which you can see on your account. Tax is reconciled with Inland Revenue at 31 March or is triggered at the time of a withdrawal or switch (to take into account the portion of the year you’ve been investing).

Prescribed Investor Rate (PIR)

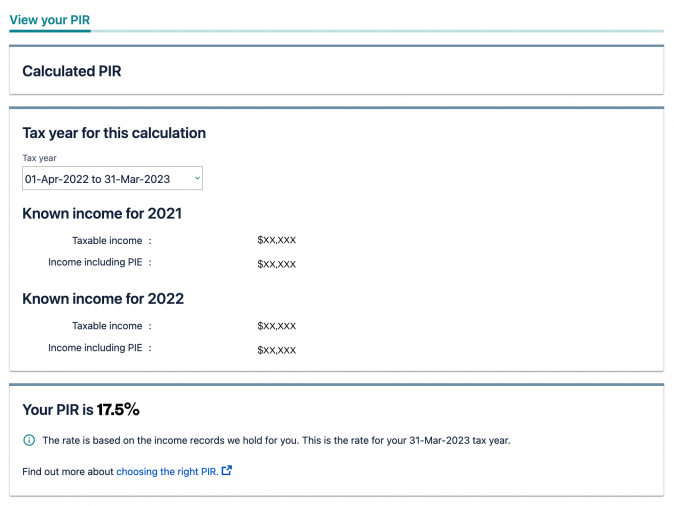

If your KiwiSaver scheme is a portfolio investment entity (PIE - most KiwiSaver schemes are PIEs, but check your KiwiSaver provider’s website or look at their Product Disclosure statement if you are not sure), the tax rate applied to your KiwiSaver investment earnings is your PIR. It loosely correlates to your personal tax rate and is based on your last two years’ earnings. There are three different PIR rates - 28%, 17.5% or 10.5% - you can calculate your own PIR using Inland Revenue’s PIR calculator here.

Remember that if you don’t tell your KiwiSaver provider what your PIR is, they’ll apply a default PIR of 28%. If you’ve advised your provider of a PIR rate and it changes you also need to notify them, so it’s important that you check the PIR on your annual tax certificate, and let your provider know if it needs to be updated.

Another way to check your PIR at any time is to log into MyIR, go to the KiwiSaver section and click “More”, then click “View your PIR”.

If you need to change the PIR rate shown, contact your fund provider or Inland Revenue. If you’re a Simplicity KiwiSaver member you can change your PIR rate online by logging into your member account.

In the myIR portal, you can also see other useful information about your KiwiSaver, including the Scheme details and your contribution rate.

How exactly am I taxed on investment earnings?

The underlying investments held by KiwiSaver funds are taxed based on the local tax regime where they are held.

So, for example, there is no tax paid on capital gains from New Zealand and Australian shares; only on dividends. Investments in international shares are taxed under the fair dividend rate (FDR) regime, where tax is paid on an assumed 5% rate of return, regardless of the actual return. All returns from bonds, both local and international, are taxed as income.

Please note that these tax regimes apply regardless of whether the fund’s performance has been positive or negative.

"Where a KiwiSaver fund is a PIE, taxable income is calculated daily within the fund and only displayed on your account if you make a permitted withdrawal e.g. a first home or retirement withdrawal. Otherwise, your PIE tax is accounted for at the end of each financial year at your PIR.

Government Contributions (formerly known as member tax credits)

The Government Contribution (previously named the member tax credit or MTC) is effectively an annual reward for investing your own money into KiwiSaver. To be eligible to receive the full Government Contribution, you need to be between the ages of 18 and 65, living in New Zealand and a KiwiSaver member for a full year. If you were eligible for a portion of the KiwiSaver year (1 July - 30 June) you’ll be eligible for a partial Government Contribution.

To get the maximum Government Contribution amount of $521.43, you must have contributed $1,042.86 between 1 July and 30 June. Only your own contributions count i.e. employee or voluntary contributions qualify (not your employer’s). If you contribute less than $1,042.86 during the year, then you may still qualify for a partial Government Contribution. To get the maximum, you need to contribute on average $21 a week. If you’re self-employed, it may be helpful to set up auto-payments into your KiwiSaver account so you don’t have to come up with $1,042.86 last minute.

If you stop contributing regularly, for example if you take unpaid maternity leave or are on a savings suspension, you can still contribute the $1,042.86 during the KiwiSaver year, to make sure you’re eligible to get the extra $521.43 from the Government. It’s like a 50% return on investment!

If you’re still unclear on anything to do with tax or your KiwiSaver scheme and how it works, you can contact us at info@simplicity.kiwi.