Competitive first home mortgage rates for members

We offer low-cost mortgage loans to qualifying Simplicity KiwiSaver members purchasing their first home - and now a refinancing option too.

These loans are designed to help members get into their first home - and out of debt - faster. For the mortgage portfolio, we aim to achieve returns higher than the Bloomberg NZ Bond Bank Bill Index.

As a nonprofit fund manager, Simplicity keeps management fees low and focuses on delivering strong, long-term investment returns for members - much like the building societies and thrift institutions that have served communities for generations.

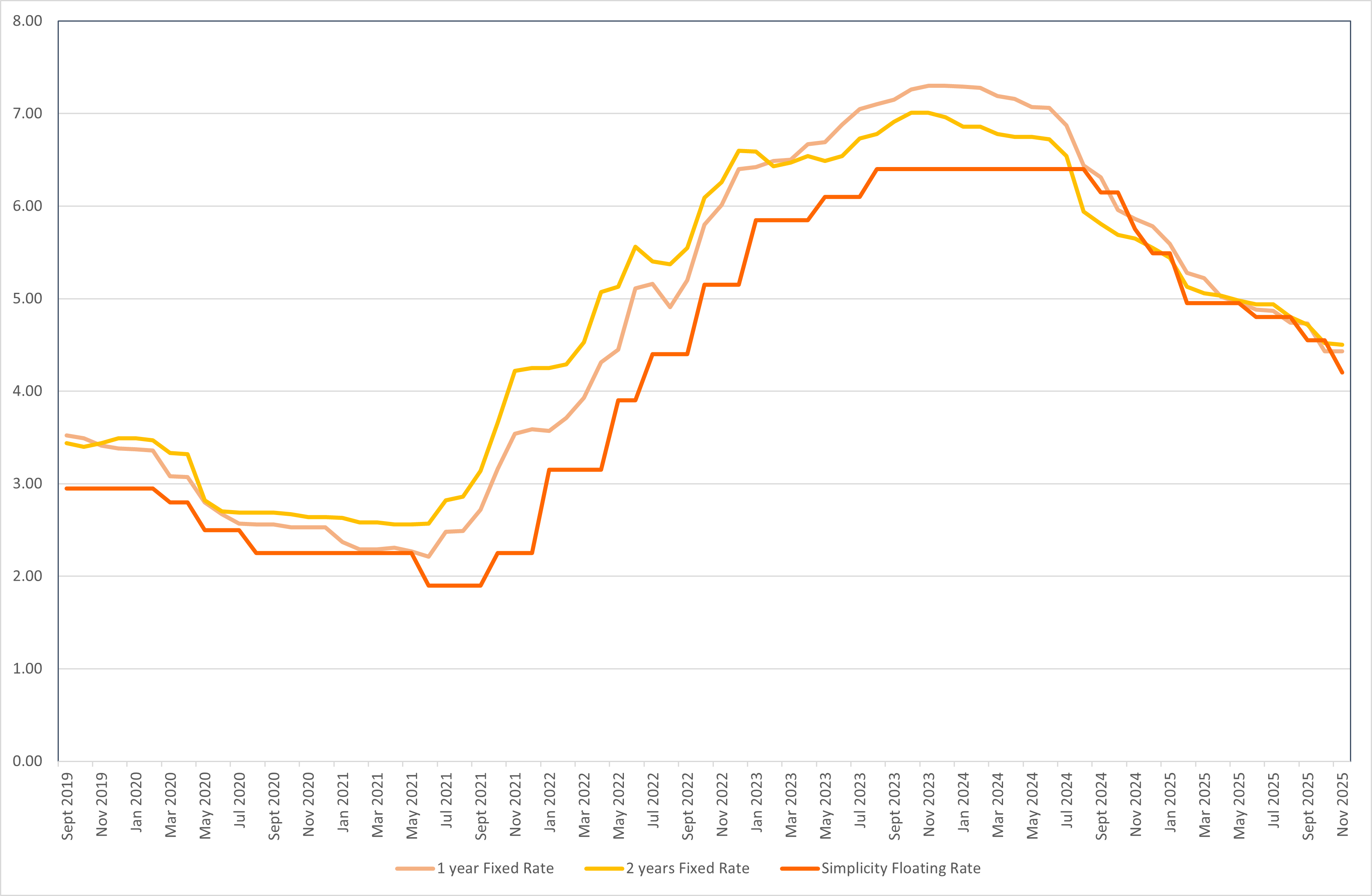

Simplicity Floating Mortgage Rate vs Average Market Mortgage Rates

Average market mortgage rates are sourced from the Reserve Bank of New Zealand New residential mortgage special interest rates (B21) as at 30 November 2025. This data series does not include market floating rates but is considered to be the most comparable rates to the Simplicity’s floating mortgage rate.