Learn » Simplicity Research Hub » What's driving inflation this time?

What's driving inflation this time?

Published on 21/07/2025

By Shamubeel Eaqub, Chief Economist - Simplicity Research Hub

Cost of living is up again

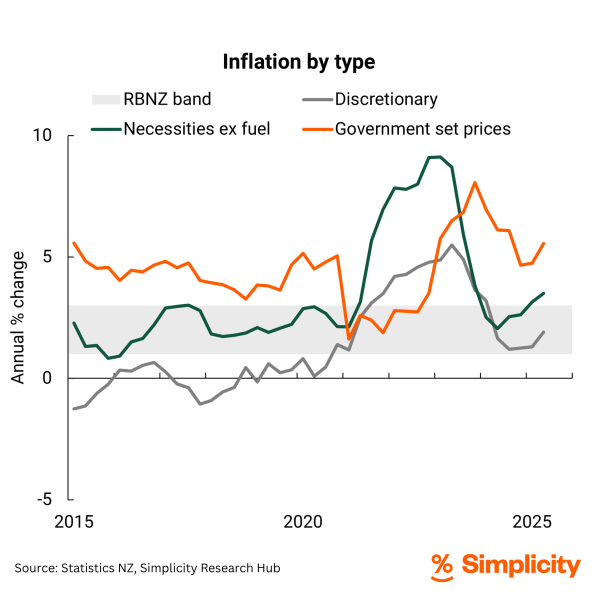

Government charges (like rates) and necessities (food, utilities, rent) continue to weigh on household spending in 2025, hitting those at the margins the hardest.

2022 and 2023 brought different types of inflation. First, we saw a mix of pandemic restrictions and global stimulus. Demand rose, but supply chains were clogged, pushing up the cost of living in a synchronised way around the world. Then, as restrictions eased but stimulus and strong spending remained, prices continued to rise. It wasn’t just the basics - it was also discretionary goods and services.

This recent lift in inflation is different

The current increase in inflation is more concentrated in government charges (especially local council rates, which largely reflect decades of underinvestment in infrastructure that can no longer be deferred), as well as necessities like food, insurance, utilities, and rent (though rent pressures are easing in some markets such as Auckland and Wellington).

There’s also been a lift in the price of some discretionary items (non-essential goods and services), though it doesn’t yet appear to be demand-driven - which would signal a recovering economy. If it were, the RBNZ would likely hold off on rate cuts - and might even signal interest rate hikes ahead.

But the economy remains weak, and this kind of inflation is the worst kind: the kind that makes people poorer. It’s not that we want to spend more on rates, food, electricity or insurance. But we have to - meaning there is less money left for everything else.

So, what does this mean for the RBNZ?

This kind of inflation doesn’t yet pose a serious monetary policy risk. But the RBNZ will be watching closely. As we’ve seen, they remain laser-focused on inflation, even when the broader economy is in a deep hole (like it appears to be now).

It’s not all bad news

For those who haven’t lost work, wages are improving and providing some cushion. Job ads remain low, so the labour market isn’t yet recovering - but job losses have stabilised. Mortgage holders have benefitted from refixing at lower interest rates, which look set to remain low for at least a bit longer.

So far, 2025 has underwhelmed

For those who have lost jobs or hours, it’s a much tougher picture. There’s little relief from the mix of higher living costs and an ongoing soft economy. Getting good advice to maximise income (e.g. by making sure you are claiming all entitlements), rationalising debt, and getting together a good budget can all help. Financial mentors can really help here.

The year so far has fallen below expectations. There has been a slow increase in some economic indicators, but much slower than expectations of businesses and consumers. If you are feeling a bit underwhelmed, you're not alone.

Figure 1: Inflation has picked up, because of government charges and unavoidable necessities. But there's been an uptick in other prices too.

This is Simplicity Research Hub’s independent expert commentary and thought leadership on economic trends and policies of interest to all New Zealanders. This content is our opinions and is provided for general information only. It does not relate to your particular financial situation or goals and is not financial advice or recommendations. Any external resources provided are accessed at your own risk and the Simplicity Research Hub takes no responsibility for third party content and does not approve, recommend, or endorse any external websites or the content they contain.