Learn » Simplicity Research Hub » First salvos fired in new trade war

First salvos fired in new trade war

Published on 03/02/2025

By Shamubeel Eaqub, Chief Economist, & Rosie Collins, Economist - Simplicity Research Hub

The US imposed big tariffs on Mexico (paused after one day), Canada and China - even more was touted in the election campaign. The new tariffs have been more severe than markets had priced in, causing ructions. For now, the impact on New Zealand is through the weakening of the NZD, an increase in interest rates, falling stock prices, and risk of secondary effects from tariffs affecting the Chinese economy in particular. It is just the beginning, and we’re going to have to wait and see.

What are tariffs - and why do they matter?

Tariffs are a tax on imports, making goods from certain countries more expensive. The newly announced tariffs are 25% for Mexico and Canada (10% for energy) and 10% for China. This makes 40% of imports more expensive for US consumers and businesses. It reduces demand for exports for affected countries, because their products are now more expensive.

There is little evidence that tariffs help domestic producers - they are political tools, not economic ones. Analysis of the last Trump tariffs showed they did not create new American jobs, but tariffs were very popular with his base.

Even if not unpopular, US consumers will pay more with more inflation, and interest rates are likely to be higher than they would have been without tariffs. Because US interest rates are the global reference point, it will likely lead to higher interest rates at the margin in New Zealand. It will likely affect longer term interest rates, the cost of borrowing for government, businesses and households (mortgages).

The stated motivation of these tariffs is to create political pressure to curb flows of illegal migrants and drugs. Tariffs on Mexico were paused after one day to negotiate. But this does not justify sparring with Canada - a long time ally and trade partner of the US. Trump says: "Those days are over”. Rich Arctic resources and the rapidly melting North due to climate change are raising serious geopolitical concerns for North America.

The uncertainty is likely to continue and expand.

How will other countries respond?

For Mexico, Canada and China, calculated retaliation (and engagement in negotiations) is the next step. For Canada and Mexico especially, the tariffs are a big blow. Around three quarters of their exports go to the USA. For China, around 15% of its exports go to the USA. But the impact is higher for many products, especially high value items like electronics.

This is important for New Zealand as China is our biggest trading partner and the tariffs come on top of an already weak Chinese economy. This secondary channel is important because China accounts for 26% of our goods exports, while Canada (1.6%) and Mexico (0.7%) are very small.

US tariffs will not be a one-off. Affected countries will retaliate and it will escalate into a trade war. In Canada, nine in 10 business leaders in Canada support strong retaliation - they are willing to wear the pain to stand up to America. Their staying power and support from the EU and other Commonwealth nations like ours, the UK, and Australia remains to be seen.

Reliance isn’t just one way. Around a quarter of US crude oil production relies on Canadian oil - some refineries are set up for this kind of heavy crude and cannot substitute for domestic crude. Canada could make key US energy sectors hurt - but would be interpreted as economic warfare in the US.

Will it last and will it spread? There is inherent unpredictability of a Trump administration. Mexico tariffs were paused after one day. It would be a mistake to assume that there is an inevitable or predictable policy pathway. If tariffs spread further afield, New Zealand exporters could be caught in the net. NZ businesses that manufacture in Mexico and Canada are already affected.

Lessons from Brexit and Australia

Brexit and China’s restrictions on some Australian products in recent years provide some lessons. First, that when a country loses favourable access to a large market, it affects local businesses a great deal. Business investment fell sharply in the UK through Brexit. Second, not all is lost when a large trading partner turns hostile. Many, not all, industries in Australia were able to pivot their exports to other markets when China imposed restrictions.

The DHL global connectedness tracker for example shows that the last term of Trump did not have a perceptible impact on global trade. It changed the nature and shape of it, but did not derail it entirely.

Will it cause permanent damage? Trade wars can weaken relationships, which are important for other things, especially security. With the US waging economic war with its neighbours and close economic partners, it is conceivable that global security arrangements will be at risk. These global relationships were also crucial for supra-national agencies like the World Trade Organisation and UN. Without US leadership and coordination of key allies, will these organisations still hold? Without these, a small rule-abiding country like New Zealand has little leverage.

How does this impact NZ?

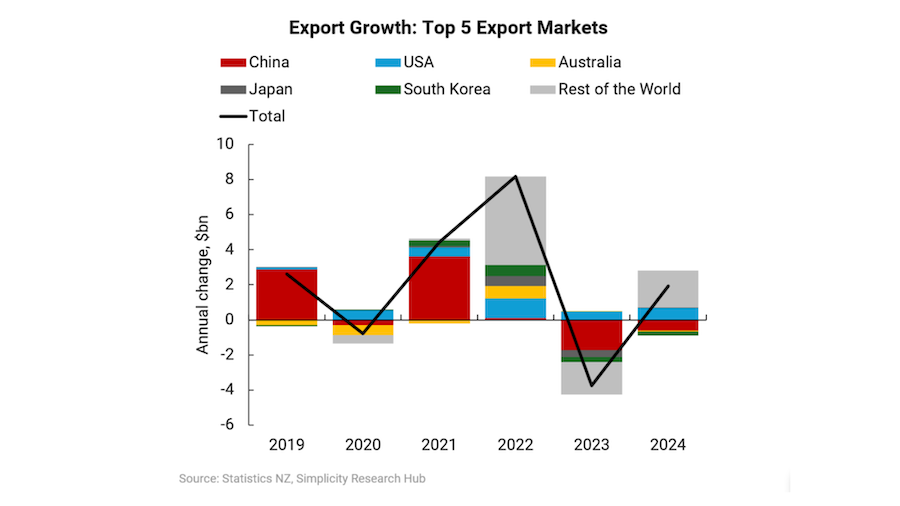

NZ is not immune, because the US is our second biggest export market and has been growing in recent years. US growth offset weakness in many of our traditional export markets, especially our biggest trading partner, China. In fact, the US was the only one of the top five export destinations to grow in the last two years. NZ businesses that are heavily exposed to the US, are going to be most in the firing line. Any further weakness in the Chinese economy will also affect our exports. We may also face slightly higher interest rates, lower exchange rates and increased uncertainty in share prices.

How widespread, how high and for how long the tariffs last will be crucial for how the global economy and global relationships are affected. For now, these cannot yet be answered and New Zealand, like the rest of the world, is on a watching brief.  Figure 1: NZ’s exports have grown to the US in the last two years, the only one of our top 5 markets.

Figure 1: NZ’s exports have grown to the US in the last two years, the only one of our top 5 markets.