Learn » Simplicity Research Hub » OCR cut is a good start, but NZ must do more

OCR cut is a good start, but NZ must do more

Published on 09/04/2025

By Shamubeel Eaqub, Chief Economist - Simplicity Research Hub

UPDATE [11 April 2025]

Tariffs: on again; off again; US-China trade war escalates. Markets gyrate. Focus on what you can control.

Markets have rebounded, regaining much of the ground lost following widespread tariffs imposed on 'Liberation day' were paused for 90 days, but not for China (our biggest trading partner). This confirms that we are in uncertain times. Trump is unpredictable, as are the consequences of unorthodox policies and attacks on American institutions. None of us should pretend to forecast what is impossible.

What can we do? The prescriptions remain the same:

- Individually, focus on what you can control and pull those levers. When it comes to your savings, the advice is still to ensure you are in the right kind of fund for your personal circumstances and you are contributing regularly, to smooth out these vagaries.

- RBNZ stands ready to support the economy should it need to. It really needs to give greater weight to jobs rather than inflation. The risks are asymmetric.

- Government should look to boost infrastructure investment, to provide much needed resilience in the domestic eocnomy, and as PM Christopher Luxon noted in his excellent speech on foreign trade, we need to play an active and leading role in creating the alternative bloc of countries that nurture and promote a rules based and fair trade system.

I spoke about this last weekend on RNZ, for those who prefer an audio version.

Happy weekend and happy school holidays.

Shamubeel

-------

ORIGINAL POST [9 April 2025]

The Reserve Bank NZ (RBNZ) reduced interest rates by 0.25 percentage points to 3.5%. Good. They can, and will, have to do more. As should the government in the May budget.

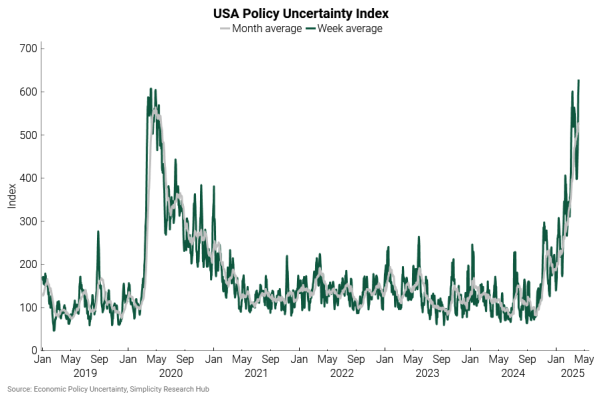

Backdrop: The world is at the start of an escalating trade war - unlike anything in the last century. US policy uncertainty is as high as it was when the pandemic began - when there was a knowledge vacuum. We are in uncharted territory (chart below - pun intended).

The risks to the global economy, especially for our major trading partners, are significant. Even if tariffs are changed, the damage may linger.

Our exports to the U.S. now face 10% tariffs. Our top 20 trading partners are facing tariffs of 60%+, and our top export market - China - has vowed to "fight to the end"!

Policy considerations: Growth and inflation are both likely to fall. Tariffs are an inefficient tax on consumers, making them poorer, which reduces spending and disrupts economic activity. Global demand will slow. Already, commodity prices are falling- and further declines are likely- initially due to goods flooding untariffed markets, and later from reduced demand.

NZ policy choices: Two key levers to pull - monetary and fiscal policy.

The RBNZ needs to deliver a programme of interest rate cuts - a clear commitment to cushioning New Zealand households and businesses. Their language remains too focused on inflation and not enough on jobs and the wider economy. They're stuck in the pandemic mindset - it's not like that anymore.

Also, unlike the mistakes made during the pandemic, this time the RBNZ should encourage bank lending for businesses and farms, rather than fuelling trading in second-hand houses.

The government needs to quickly reverse austerity in the May budget by massively increasing infrastructure investment - unleashing maintenance work and greenlighting a pipeline of projects - with solid cross-party support, not just pet projects. This is proven good policy in a recession.

Kiwis aren’t interested in petty politics in the middle of a once-in-a-century global dislocation. This is the hour for leadership.

Action: You- as individuals and leaders - can do three things, from this economist’s perspective.

First - be informed - understand the wider context - but don’t become paralysed by it. The news is a fire hydrant gushing out fear; dip into it briefly and sparingly.

Second - focus your energy on: how does this affect you and/or your business?

Third - ask: what can you do?

The more you focus on these two things - by personalising the issues and identifying the actions you can take - the more agency and sense of control you'll have.

You'll be ready to act, and be philosophical about the things you can't control.

When the world seems mad and the news spells heightened unpredictability, the old comforts remain: family, friends, and community. A bit twee, but true. Take control and take care.