Learn » Simplicity Research Hub » The OCR cut: Ongoing risks and reasons for optimism

The OCR cut: Ongoing risks and reasons for optimism

Published on 19/02/2025

By Shamubeel Eaqub, Chief Economist - Simplicity Research Hub

The Reserve Bank New Zealand (RBNZ) reduced the official cash rate (OCR) by 0.5% points to 3.75% in February 2025. The lowest since late 2022. This is good news – it will spur economic recovery through the middle of the year.

The RBNZ sets the OCR today to influence savings and investment decisions that will filter through to economic growth and inflation outcomes in around a year.

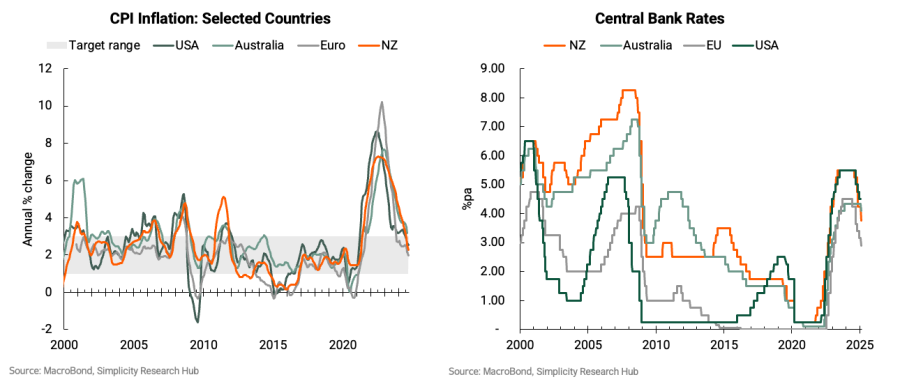

The reduction in interest rates is desperately needed. The economy is in recession: businesses are closing, and people are losing their jobs. There is evidence that inflation is also moderating – the RBNZ’s main job. In fact, inflation has slowed across major economies, but it's not yet beaten in every place or every industry. So, the RBNZ will remain vigilant.

When the OCR falls, it influences the cost of borrowing for households and businesses. The impact is greater for floating mortgages than longer term fixed mortgages. The latter have already moved lower in anticipation of the OCR cuts. But more mortgage rate reductions are possible, because banks are currently charging a big margin over their funding costs. People refixing their mortgages will be relieved, as they will be refixing to lower rates.

Banks are also seeing more loan applications, meaning we will see borrowers paying less for mortgages (so about a third of households who have mortgages will have more money in their back pocket) and more people will borrow and invest more.

As household budgets ease, retail and hospitality sectors are likely to benefit from people spending more. House sales and house building should begin to increase too.

The RBNZ will probably lower interest rates by another 0.50-0.75%pt, depending on how the economy is faring. This would be a big boost to the economy towards the middle part of this year.

There are three risks to the economic outlook. Slowing net migration and fiscal austerity (especially reduction in infrastructure investment) will drag on the recovery. Global uncertainty is high on economic, political and security fronts, which could affect our exports.

Despite these risks, there are encouraging signs the RBNZ is moving from fighting inflation with a recession they engineered, to nurturing the economy. After a tough couple of years, households and businesses can be more optimistic on the economy, and their own prospects.

Relief on inflation and rates

Figure 1&2: Consumers Price Index inflation V Central Bank Rates - 2000-2025 in NZ, Australia, Europe & US

Source: MacroBond, Simplicity Research Hub