Learn » Simplicity Research Hub » Hardship withdrawals are rising - and telling us something important

Hardship withdrawals are rising - and telling us something important

Published on 01/08/2025

By Shamubeel Eaqub, Chief Economist - Simplicity Research Hub

More Kiwis are doing it tough. In the year to June 2025, over 53,000 people made KiwiSaver hardship withdrawals - up from around 18,000 five years ago.

This isn’t a new trend. The sharp increase began in 2023, driven by a prolonged recession and a cost-of-living crisis that continues to bite. In the last year alone, the number of people on Jobseeker support has grown by 10%, or around 20,000 people.

But a little context is important.

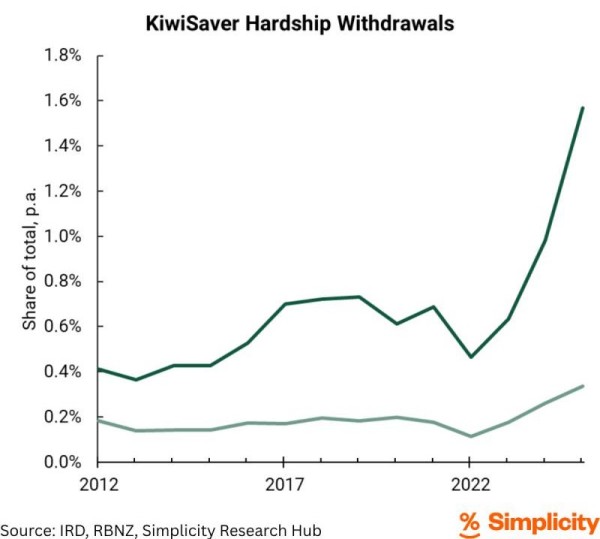

Hardship withdrawals affected around 1.6% of KiwiSaver members, and represented just 0.3% of total savings. In other words, the pain is real, but it’s concentrated. Just like in wider society, a smaller group is bearing the brunt of economic stress.

The average hardship withdrawal was around $8,000 - and yes, that does reduce future retirement income. But for many, it’s a choice between less in retirement or not making it through the present.

Another concern is those who aren’t in KiwiSaver at all. Many low-income earners don’t contribute, often because even a 3% employee contribution means a lower take-home pay. But by not contributing, they also miss out on employer contributions and government subsidies. So when hardship hits, there’s no savings buffer to fall back on.

The job market and economy remain sluggish. We’re not out of the woods yet, and for many, this recession still feels very real.

If you or someone you know is struggling, support is available.

MoneyTalks is a great first step, or reach out to a friend, colleague, or trusted adviser. No one should have to face financial hardship alone.

Figure 1: Hardship withdrawals are nearly 3 x the pre-pandemic average.